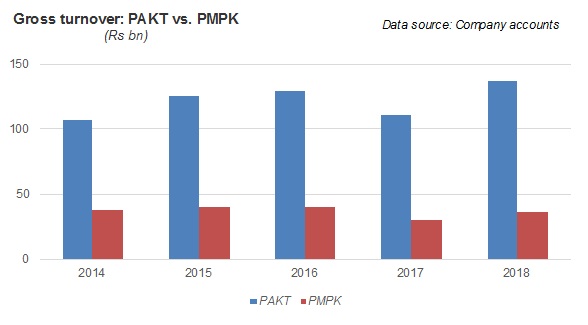

The company manufactures and sells a number of cigarette brands, including Gold Leaf, Capstan, Dunhill, Benson & Hedges, Gold Flake and Embassy. PAKT is the market leader, commanding 71 percent of market share in the legitimate cigarette market as of 2018, as per the company. At number two is Philip Morris Pakistan Limited (PSX: PMPKL), with roughly 20 percent share of the organized market.

PAKT is among major taxpayers in Pakistan. During 2018, the company paid Rs92.2 billion to the exchequer in terms of excise duty, sales tax, custom duties, surcharges and income tax. But PAKT, along with PMPK and smaller tobacco players, share the common threat of illicit cigarette sales - counterfeit, smuggled, and duty-evasive products - that have invaded the market in recent years. As per PAKT management, illicit cigarettes accounted for 33.2 percent of the overall tobacco industry in 2018.

Recent financial performance

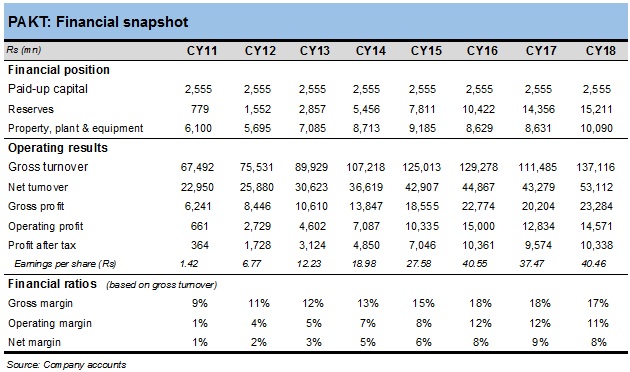

Throughout this decade, PAKT has gradually expanded its gross turnover. In CY18, gross turnover was more than double from the figure in CY11. The gross, operating and net profit margins have visibly improved in recent years. The company's bottom-line has averaged ten billion rupees in the last three years, but the impressive feat has come about in challenging times for the formal tobacco sector.

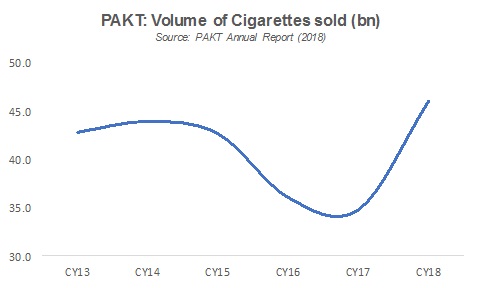

Based on publicly available data, it seems that the formal tobacco industry caught a cold in the second half of 2016 that lasted for much of early 2017.

The formal sector was apparently being undercut by the duty-evading cigarette manufacturers in the informal market. Rising FED on formal tobacco industry along with a weak enforcement regime to curb illicit trade meant that the price gap between formal and informal sector cigarette products grew. The industry suggested in early 2017 that the price differential had grown to a dangerous level where it was hurting tobacco industry revenues as well as government taxes.

The impact that was felt by PAKT was visible in CY17 financials, with the company's gross turnover and profit after tax taking a noticeable hit. PMPK's fortunes went the same way. The government, noticing the slide in its tobacco-related duties and taxes for FY17, responded to the industry's plight by introducing a third, lower tier to the hitherto two-tier FED regime for cigarettes, in May 2017, as part of the FY18 budget.

This bottom tier had a lower FED, which effectively helped players like PAKT and PMPK recoup their market share from the duty-non-paid (DNP) brands in the market. The formal industry, which suffered revenue losses in much of 2HCY16 and 1HCY17 due to the purported rise of DNP cigarette sales, was competitive again from 2HCY17 and onwards. The third tier, however, became controversial among public health advocates, as it made cigarettes cheaper in the low-end segment of the market, potentially leading to more smoking incidence.

But the third tier has met the fiscal objectives. The market leader PAKT, just as PMPK, benefited not only from the double-digit year-on-year revenue growth that came along in CY18, but it also retained more percentage points of gross turnover in the form of net turnover. That is because the effective FED rate, thanks to the lowest tier, had fallen for CY18 and much of CY17. In CY18 and CY17, PAKT retained 39 percent of gross turnover as net turnover, higher than the average 34 percent retained in the prior three years.

This dual reprieve - top-line growth and higher revenue retention - helped PAKT bounce back quickly from the brief financial setback in late 2016 and early 2017. As for the government, it also recovered its tobacco revenues from the industry. For its part, PAKT contributed Rs88.9 billion in the form of sales tax, excise duty and income tax in CY18, up from Rs71.6 billion collected on those counts in CY17. Those government revenues from PAKT in CY18 reached almost the same level as in CY16.

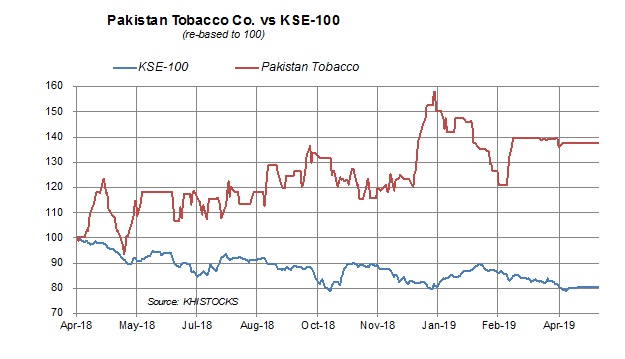

Stock performance

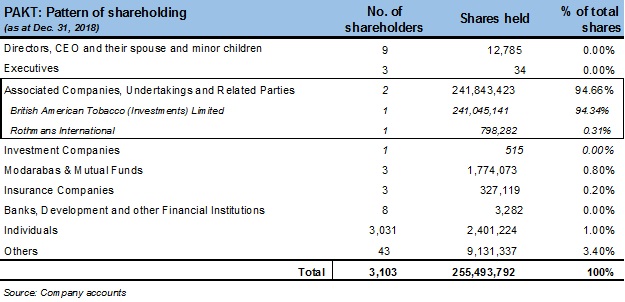

Over at the bourse, PAKT's stock has risen more than a third in value in the last 52-week period, standing at Rs2,613 per share as of April 15, 2019. PAKT has significantly outperformed the KSE-100 index in that period. The stock, which has a 5 percent free float or 12 million shares, is, however, among the thinly traded stocks on the PSX.

Outlook

The continuation of the three-tier FED regime is expected to keep the formal industry competitive against DNP brands and help the government revenues to grow from this sector. It is expected that the upcoming budget will raise the FED for the lowest tier - FED hikes are usually the norm every budget. Whether or not that raise is inflation-adjusted or some percentage points more remains to be seen. If any meaningful crackdown/ enforcement measures are announced against the illicit sector, it will provide the formal industry with a more level-playing field.