With capacity enhancements and modernization, this capacity was taken up to 1.8 million tons by FY16. At that capacity, Attock should have 4 percent share in the market size, though market share should be much higher (around 24%) in the South as that's the local market it caters to. Attock also exports cement to Sri Lanka, Mauritius, Sudan, India, Tanzania and Somalia and is exploring new exporting markets as the industry expands capacity. With the latest capacity enhancement, the company now contributes nearly 6 percent capacity to the industry.

Shareholdings and expansions

Attock's holding company Pharaon Investment held more than 84 percent shares in the company. The Pharaon group has a range of investments in the areas of oil and gas, power generation and information technology. Other group companies include Pakistan Oilfields Limited set up in 1950, Attock Refinery (1922), Attock Petroleum Limited that was established jointly by the Pharaon Investment Group Limited Holding (PIGL) and Attock Oil Group of Companies (1995). In 2005, the group also took over National Refinery Limited (NRL) in 2005. The rest of Attock's shares are distributed between banks, DFIs, Modrabas, Mutual Funds and institutional investors. The public held 4.92 percent of the company's shares for the year ending June 2018.

Attock came online with its most recent expansion in Jan-18, a third line of brownfield expansion in Hub with a capacity of 1.2 million tons. The initial capital outlay of the project was $120 million and the plant came with its own waste heat recovery (WHR) unit which started operations in Apr-18.

Attock has also made investments in a cement grinding unit in Iraq by entering into a joint venture (Attock: 60%) with the Iraq-based Al Geetan Commercial Agencies to form a subsidiary, a limited liability company. The mill has a capacity of 0.9 million tons at a cost of $24 million. The mill will soon enter into trial phase of production after the company obtains required permissions to import clinker.

Operational and financial performance

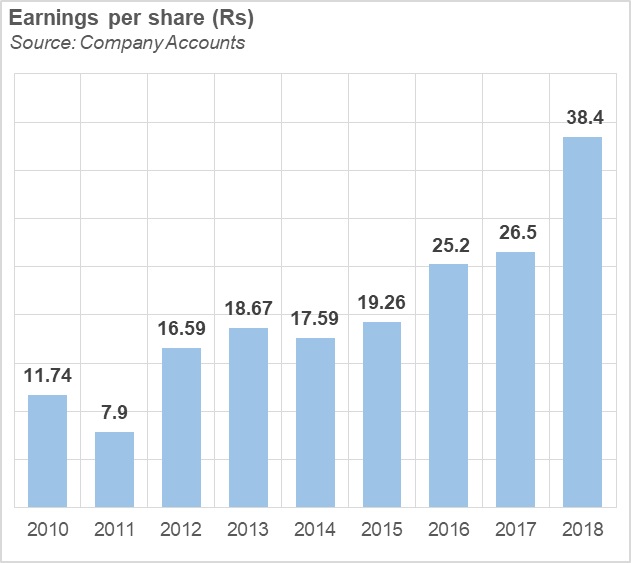

Attock cement has maintained stability over the 7-8 years with high capacity utilization and consistent growth in revenues despite the slowdown in demand the industry experienced during some years. The revenue CAGR between FY10 and FY18 has been 9 percent and the average growth is 11 percent which is pretty decent especially since during some years, production slid down.

The company has been operating two production lines and added a third line in Jan-18. Capacity utilization for its facilities has remained nearly 100 percent as the company has aimed to maximize plant efficiencies. Being in the south gives Attock the advantage that many companies in the north do not enjoy- the advantage of proximity to the port. This allows import inputs costs (coal and other fuels) to be comparatively lower and ability to reach more export markets. Since there are fewer players in the south, the companies in the region also get higher value (about 10-12%) for cement bags compared to the players in the north.

Since the introduction of line-3, the company has been trying to export more. This is one of the reasons why Pakistan's sea borne cement exports have increased. The company is attempting to explore markets like Bangladesh, Kenya, Tanzania, and Sri Lanka for export of clinker and has secured orders as well. The opportunity has arisen recently as some of the plants in China have shut down due to environment reasons. Aside from supplying to local southern markets, the company has also supplied to upper Sindh, lower Punjab areas during times when diesel prices were affordable.

Strong demand prospects encouraged cement manufacturers to enhance capacities. The industry is now expanding to 70 million tons by FY21. But when FY17 hit, the cost and price dynamics shifted, some affected both north and south players and some just north players. Coal being a major fuel input used by cement manufacturers is usually imported so international coal prices play a dominant role in the costs of production. The coal price trends have been going up since that year. During FY18, the depreciating rupee against the dollar also raised costs significantly. This translated to Attock's margins that had strengthened previously during Fy15 and Fy16 dropping to 31 percent during FY18, and this trend has continued well into FY19.

Attock has attempted to improve cost efficiency through the overhaul of its cement mill and introducing Variable Frequency Drives (VFDs) on its key motors that helped reduce power costs. The company also has a 40MW of coal fired power plant but in the past has found water shortages in the Hub dam to be a deterrent to running this plant.

Exports have also grown for the company much like the rest of the sector- but predominantly to Afghanistan and the Indian markets. They went up from 26 percent of all sales in FY13 to 39 percent in FY15. Exports tend to fetch less prices but when local demand wanes, cement manufacturers turn to exports. While exports fell during between FY16 and FY18 overall for the industry due to Afghanistan's market being less favorable for Pakistani cement and South Africa imposing anti-dumping duties, local demand made up for it. Attock exported to Sri Lanka, Yemen, India and East African economies.

Latest financials, opportunities and outlook

The current fiscal year is not going to be the best for cement manufacturers in general. Attock's half yearly financial showed that despite a strong growth in revenues, margins and bottom-line went tumbling down. Local demand sobered down and it was strong tilt toward exporting markets that allowed Attock to register such a higher revenue growth of 44 percent. Margins however took a hit since revenue did not grow as much as they could have since exports fetch lower prices.

Moreover, higher fuel prices, and currency depreciation made matters worse causing margins to shrink to 21 percent from 33 percent in 1HFY18. Coal prices grew on average by 10 percent and rupee depreciated by 14 percent depreciation between Jul-18 and Dec-18. Expansion related borrowing and higher interest rates have also translated to higher finance costs for Attock and this trend is likely to continue.

The outlook for the cement industry on the whole remains pretty somber as this year ends. Local demand has slowed down and exports will prove to say the day, but revenues per ton sold will be lower for the industry in general.

Though most of the CPEC projects are still on track, the government did cut down on PSDP funding. However, if Naya Pakistan housing plan and dam construction actually see the light of the day, the two will add significantly to the demand that cement manufacturers had not foreseen before PTI government came into power. Even so, there is no possibility of these plans materializing by the end of this fiscal.

If costs go up much more due to coal prices, or further devaluation and cement manufacturers cannot pass these on to consumers, their margins will suffer much more. Higher cost of borrowing and distribution costs due to higher exports will also affect the bottom-line.

======================================================

Attock Cement (Half Yearly Statement)

======================================================

Rs (mn) 1HFY19 1HFY18 YoY

======================================================

Sales 10,634.22 7,362.92 44.4%

Cost of Sales 8,385.95 4,964.51 68.9%

Gross Profit 2,248.27 2,398.41 -6.3%

Distribution costs 749.36 279.19 168.4%

Administrative 252.11 241.74 4.3%

Other operating expenses 61.00 91.74 -33.5%

Other income 134.55 27.60 387.4%

Finance costs 300.54 78.29 283.9%

Profit before tax 1,019.77 1,735.05 -41.2%

Taxation 202.98 582.13 -65.1%

Net profit for the period 816.79 1,152.92 -29.2%

Earnings per share (Rs) 5.94 8.39 -29.2%

GP margin 21% 33% -35.1%

NP margin 8% 16% -50.9%

======================================================

Source: PSX notice

=========================================================

Pattern of Shareholding (as on June 30, 2018)

=========================================================

Categories of Shareholders Share

=========================================================

Directors and their spouse(s) and minor children 0.110%

Pharaon Investment Group Limited , Lebanon 84.06%

Banks, development finance institutions, 1.57%

insurance, non-banking finance companies etc.

Modrabas and Mutual Funds 4.39%

Others:

Institutions 4.94%

Foreign 0.00%

Individuals 4.92%

Total 100%

=========================================================

Source: Company accounts