Over the years, the firm has grown into one of the leading manufacturers of paper and board, flexible and conventional packaging material, tissue paper, propylene films, corrugated boxes and printing inks in the country. The firm's key business partners include Unilever, Nestle Pakistan, Tri-Pack Films, Tetrapak Pakistan Limited and Coca-Cola beverages Pakistan among others.

Packages Limited in the last two decades

During 1999-2000, Packages Limited successfully completed the expansion of the flexible packaging line. The company started commercial production of corrugated boxes from its plant in Karachi by 2002.

The next round of expansion occurred in 2005 where the company tripled its paper and board capacity from 100,000 tons per annum to 300,000 tons per annum; whereas its tissue division underwent capacity enhancement in 2008 through installation of a new tissue paper manufacturing machine with production capacity of 33,000 tons per annum.

A lamination machine was installed in 2011, which was Pakistan's first high speed solvent-less automatic lamination machine. And in 2012, the company invested in a rotogravure machine for its flexible packaging business and signed a 50-50 JV agreement with Stora Enso OYJ Group of Finland in its 100 percent wholly owned subsidiary, Bulleh Shah Packaging (Private) Limited to enhance growth in the paper and board segment.

Packages Mall in Lahore is another successful initiative by the company; the development of Packages Mall was carried out through Packages' subsidiary, Packages Construction (Private) Limited in 2014.

Later in 2015, Packages also invested in a new toilet roll line and introduced a new brand called Maxob, while also concluding the acquisition of 55 percent share in the operation of a flexible packaging company in South Africa as well as initiating a 50-50 JV with Omya Group of Switzerland to set up a production facility to supply a range of high quality ground calcium carbonate products.

In 2016, the company ventured into the power sector an incorporated a wholly owned subsidiary, Packages Power (Private) Limited, for the purpose of setting up a 3.1 MW hydropower project. It also made investments in a new offset printing line to cater to the growing demand in the folding cartons business as well as in the tissue division.

In 2017, Packages further invested in the up gradation of the flexible packaging line and also in the downstream operations of lamination. In the same year, doors to the Packages Mall were open. Furthermore, it made Bulleh Shah Packing (Private) Limited its fully owned subsidiary after acquiring the remaining shares from Stora Enso.

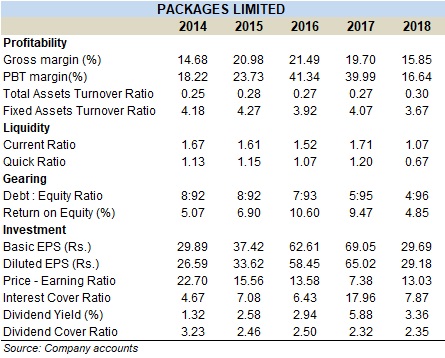

Recent financial performance

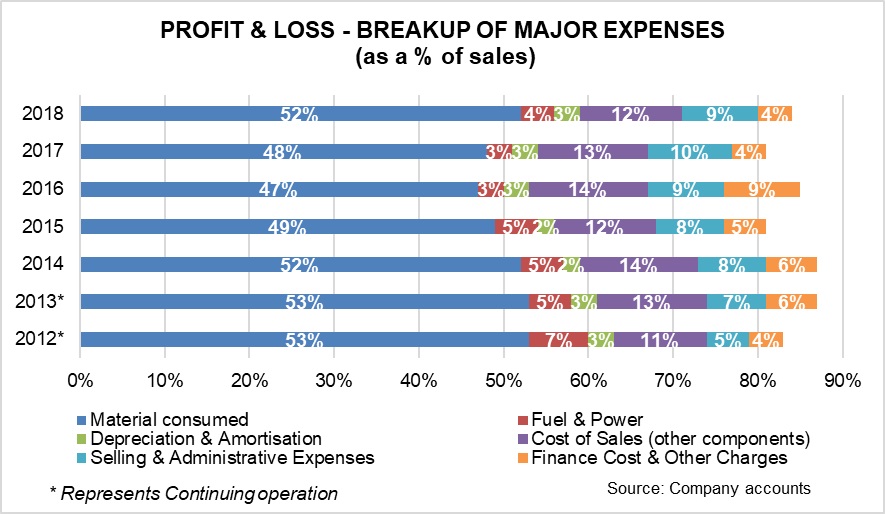

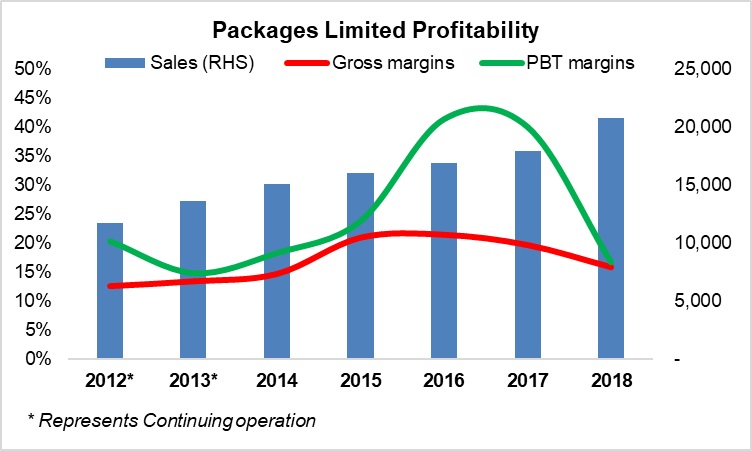

2016 was a good year for Packages Limited in terms of its financial performance. Though its net revenues were up by only five percent year-on-year, the overall volume growth was 15 percent during the year, which was offset by price discounts passed onto the customers of the packaging division due to the deflationary trends in the raw material and fuel and power costs. And despite modest revenue growth, profits for Packages Limited jumped by 70 percent year-on-year in 2016.

The Packaging Division that includes folding cartons and flexible packaging saw marginal improvement in the year 2016; while the volumes in CY16 were up by 12 percent year-on-year, the segment witnessed a drop in revenues due to price discounts on the back of deflationary trends in raw material and fuel and power costs, higher advertising expense and also lower sales of tobacco industry. On the other hand, the Consumer Product Division that includes a range of tissue and personal hygiene products did well as sales increased by 18 percent year-on-year in CY16, and the profits of the segment grew not only because of revenue growth but also improved capacity utilisation, contained operating costs and overall lower fuel and energy costs.

In 2017, the company posted 8 percent increase in sales revenues led by 7 percent growth in volumes. Profits for Packages increased by 11 percent year-on-year in 2017. However, the profits would have been much higher, but they were pulled down as the company witnessed an increased raw material cost, which was not fully passed on to the customers. Also, the firm witnessed higher advertising costs during the year.

The same year, the Packaging Division sales grew by 6 percent, year-on-year on the back of volumetric growth. During the year, the company made significant investments in machinery for enhancing capacity and quality by investing in a new, wide web Flexo Printing machine. It has also made some investments in a state of the art 7 Layer blown film Extruder and Lamination, Slitting and Bag making machines in flexible packaging division as well as equipment for folding carton division. The firm's Consumer Products Division saw a sales growth of 14 percent due to improved capacity utilisation and operating cost control initiatives.

In 2018, investment made last year for up gradation of flexible packaging line that includes wide-web Flexo Printing Press as well as a state of the art extruder were successfully completed and made operational by the company. Packages continued to invest in its lamination, printing and packaging operations in 2018.

The firm touted a 16 percent year-on-year increase in net revenues coming from 4 percent year-on-year growth in volumes. However, a 21 percent increase in the cost of sales that include cost of raw material, fuel and power led to a decline in gross profits. Higher expenses resulted in 56 percent year-on-year decline in the firm's bottom-line that came from higher rupee devaluation during the year and higher advertising expense also continued.

Packaging Division witnessed a revenue growth of 18 percent year-on year. However, earnings were impacted by higher raw material cost, currency devaluation and inflationary increase in fixed costs. The Consumer Product Division also witnessed a growth in revenues of about9 percent year-on-year. but impact of raw material price increase coupled with rupee devaluation and increase in advertisement impacted the segment's profitability adversely

2019 and beyond for Packages

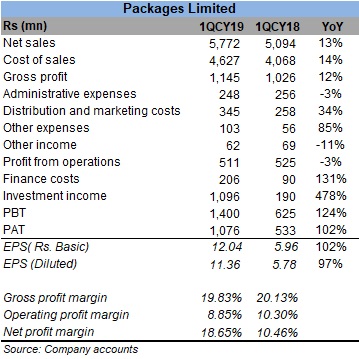

The first quarter of 2019 (1QCY19) saw an increase of 13 percent in the company's sales. However, the whopping increase in the company's earnings after tax for the period came from investment income (other income) that increased on the back of receipt of dividend from Tetra Pak in 1QCY19. Both the divisions witnessed double digit sales growth.

As per the company's quarterly report, the BoD of the company has approved internal restructuring of Packages Limited with an objective to create a holding company to develop operating synergies across businesses, and streamlining the ownership structure.

In this regard, 2 wholly owned subsidiaries will be incorporated where the company will transfer its manufacturing businesses including folding cartons, flexible packaging, consumer products and mechanical fabrication and roll covers etc. into a separate 100 percent wholly owned subsidiary. It will also transfer its investment business comprising shares of various companies, into another 100 percent wholly owned subsidiary with Packages Limited as the holding company.