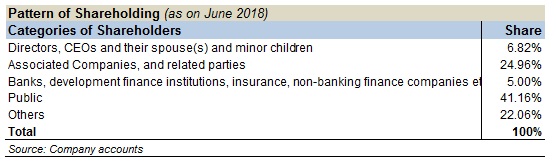

Shareholding pattern The largest shareholding in the company is held by the public which owns almost 41 percent followed by associated companies which hold almost 25 percent.

Textile sector outlook The economic slow-down has stifled any chances of recovery for the textile sector with exports in particular struggling to recover. Although textile tycoons were upbeat about the future not so long ago, the continued slide in the rupee coupled with the government's intention to remove zero-rated status for the textile industry has dampened hopes all around.

Post the IMF bailout, the economic team in charge has one primary objective and that is stabilisation. In such circumstances all special tax incentives and subsidies are likely to be cut which will result in a higher cost of production for textile firms. The rupee depreciation also means more expensive raw material which includes dyes, spares, fabric and even cotton.

There also needs to be a shift away from cotton-based exports to synthetic fibres which have increasingly displaced cotton products in the global apparel value chain. Most major textile firms have made significant inroads in the domestic markets with expanding retail presence. These would likely be able to weather the tough times ahead but things do not look rosy for the small and medium enterprises operating in the sector.

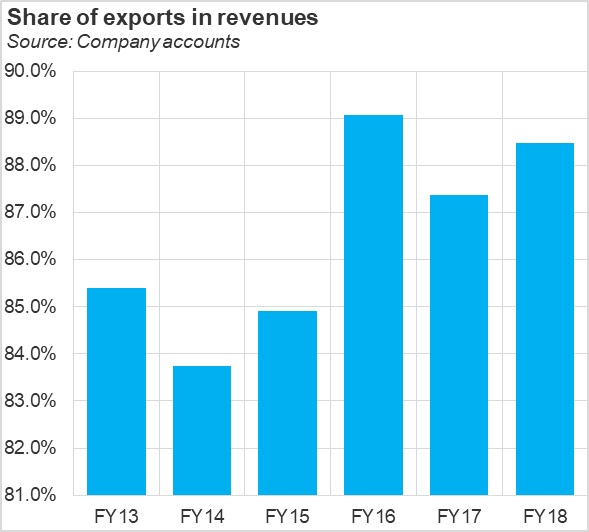

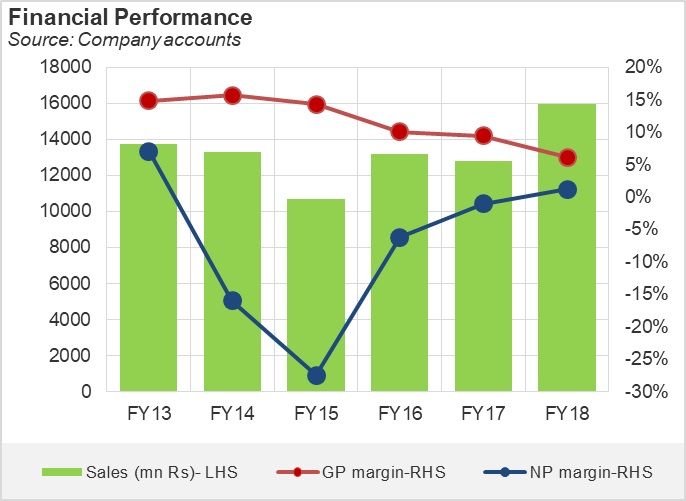

Historical performance ANL is a predominantly export based company and over the past five years has consistently managed to keep exports contribution to the top-line at over 85 percent. But this has not meant that the company has been spared from the rising cost of production which has taken a hit on the firm's profitability.

From FY14-FY17, ANL witnessed negative earnings and only managed to break this loss-making streak in FY18. In its FY18 annual report, the company highlights the devaluation of Turkish Lira as a major cause of pressure on margins and sales of the denim export business in Pakistan. The devaluation made local Turkish denim manufacturers more competitive which led to less reliance on imports. However, ANL's garments division came to the rescue by recording a 43 percent growth in revenues which helped the overall top-line increase by 25 percent on a year-on-year basis.

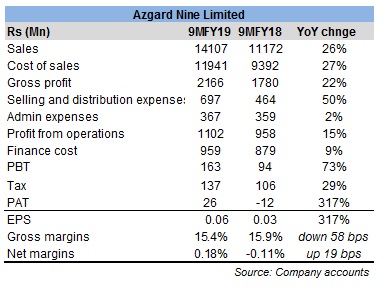

Snapshot 9MFY19 ANL fared better in the 9MFY19 period with an increase in both its top-line as well as profitability. The top-line increased by 26 percent as compared to the same period last year due to better capacity utilisation. There was an increase in the company's garment sales as well which led support to the top-line.

However, the company noted in its 9MFY19 report that margins remained compressed due to the high cost of production and the reduction in DLTL rates by the government. It also bemoaned the delay in processing of sales tax refunds by the government which has resulted in a liquidity crunch for the textile industry.

The rise in interest rates also means that textile firms including ANL will see their finance costs increased by a significant margin. ANL is pursuing a debt restructuring plan which has been approved by the Lahore High Court. Through the approved arrangement, the company will settle a major portion of the principal and mark-up on its borrowings through the sale of certain assets and a rights issue of the company's share capital.

Future outlook The past several years have seen tough international completion for ANL in the denim space and the company has realised the need to explore new markets. The company notes that saturation in its traditional export markets of Europe and America and the rising cost of production will make it more difficult to compete in the times to come.

As the textile sector is likely to get the incentives awarded to it rescinded due to the prevailing macro-economic conditions, this will likely impact export oriented firms like ANL in a more pronounced manner. The company will have to likely diversify its products in denim and garment exports while also focusing on cost minimization and operational efficiencies. The debt restructuring is also crucial for ANL in the long term as the company's borrowing costs continue to inflate.