In the same year, following international competitive bidding by the Privatisation Commission, KAPCO was privatised. At the time of privatisation and following privatisation, WAPDA divested 36 percent of its shareholding in the Company to the strategic investor. In February 2005, the Privatisation Commission on behalf of WAPDA sold another 18 percent of WAPDA shareholding in the company to the general public. The same year, KAPCO was formally listed on the Pakistan Stock Exchange. In August 2013, the strategic investor sold its entire shareholding in the company to local corporate entities and individuals. KAPCO is a multi-fuel gas-turbine power plant that can run on gas, FO and diesel to generate electricity.

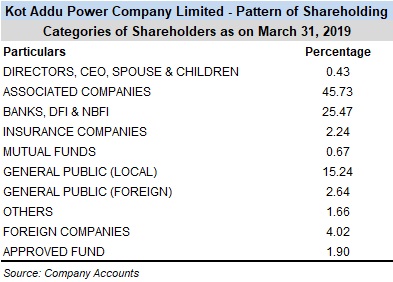

Shareholding pattern KAPCO's only customer and the largest shareholder (holding around 40 percent of the shares) is Water and Power Development Authority (WAPDA). The illustration shows other shareholders in the company's stock.

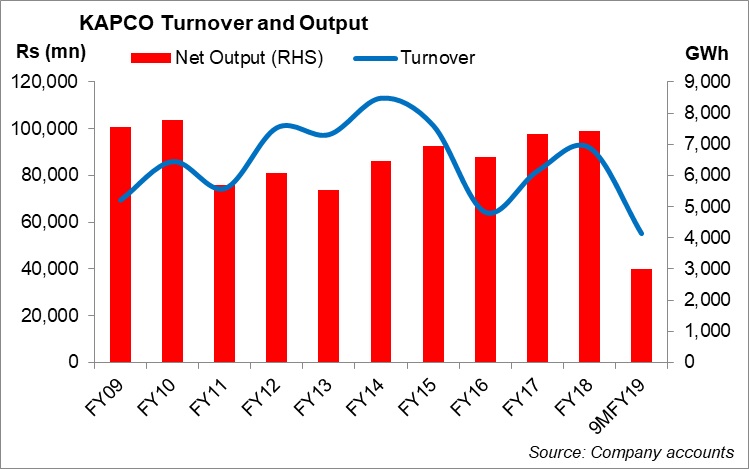

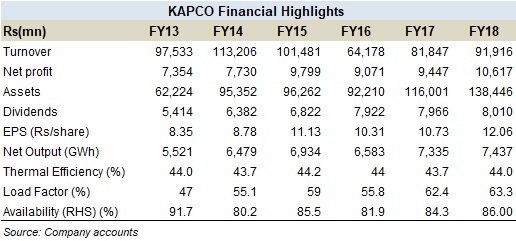

Historical performance In FY13, KAPCO along with other power sector companies benefited from the one-time payment made for the circular debt by the PML-N government. However, the profitability that picked up right after the circular debt payment remained undersized in FY14 as the year saw some major overhauls and repairs. FY15 was marked with lower oil prices, and hence, KAPCO's revenues slipped again FY15. However, gross margins improved as input cost came down.

The power sector performance was sluggish in FY16 as KAPCO's revenues fell by over 36 percent year-on-year, and higher selling expenses, and higher operations and maintenance costs squeezed earnings by 7 percent year-on-year.

KAPCO's financial performance in FY17 was better as revenue grew over 28 percent, year-on-year, due to improved generation levels in a rising input cost environment. A noticeable factor in FY17 was the decrease in the IPP's consumption of furnace oil due to the availability of RLNG to the power plant - a key policy move being made by the government across the power sector. Its profits grew by 4 percent, year-on-year in that fiscal year. Despite higher sales, disproportionate increase in cost of sales suppressed gross margins, while net margins took a beating from higher finance cost and other expenses. However, lower administrative expenses and higher other income, which is largely the penal income, supported the bottom-line.

In FY18, the company's revenues and profits both increased by over 12 percent, year-on-year. However, net output of the company stood at 7,473GWh - only up by a percent, on a year-on-year basis. Here, higher prices played its role in lifting the revenues.

On the expense side, higher cost of fuel resulted in higher cost of sales, which along loss of efficiency despite turbine overhauls pulled down the company's gross margins. However, a significant jump in other income in FY18 lifted net profits. As per the notes to the annual accounts, the jump in other income came primarily from "true-up income" along with interest on late payment from WAPDA. As per the Annual report, this extraordinary item represents income resulting from change in US Dollar - PKR exchange rate exceeding the threshold defined in PPA, compared to the rates used for indexation calculation of relevant CPP invoices.

9MFY19 and beyond

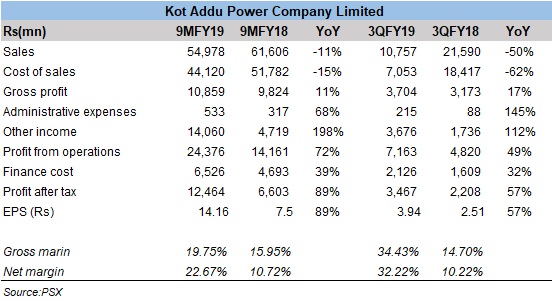

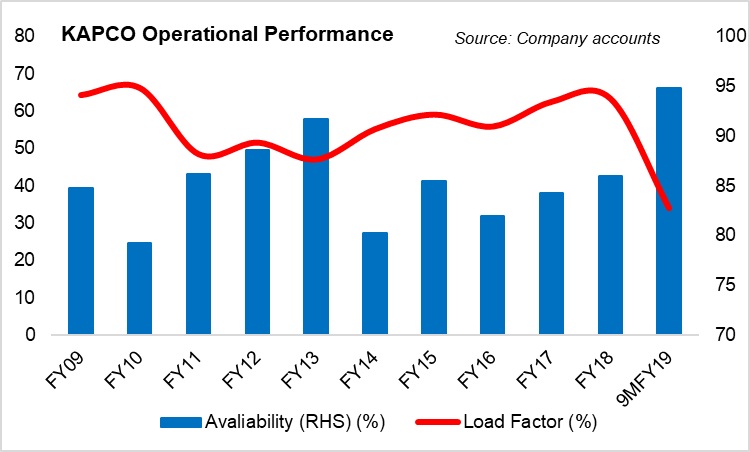

KAPCO's profitability in 9MFY19 was up on weaker currency largely. It recently announced a significant jump in earnings for 9MFY19 and 3QFY19 that did not come from growth in the IPP's top-line as revenues for the firm declined by 11 percent and 50 percent, respectively for 9MFY19 and 3QFY19. The only reason for the fall in revenues for KAPCO was lower power generated in the period under review; for 3QFY19, the IPP generated 385GWh of power with a load factor of only 13 percent, versus 58 percent in 3QFY18; similarly, the load factor remained 34 percent in 9MFY19 versus 58.7 percent in 9MFY18.

The increase in KAPCO's earnings came from a jump in other income that increased by three times in 9MFY19 and by over two times in 3QFY19 gross profits also increased as the cost of sales declined in proportion. Its profits grew by 89 percent year-on-year in 9MFY19 largely due weaker currency that inflated the ROE component of the capacity payments as well as higher other income led by piling receivables; while the growth in finance cost contained some of the growth. KAPCO's net profits likely include true-up income in 9MFY19 as well.

Though KAPCO resumed cash dividend, announcing the first interim cash dividend of Rs1.5 per share in 9MFY19, the payout was lower than dividends for 9MFY18 i.e. Rs4.35 per share. The company's liquidity took a small breather when the government injected Rs200 billion to partially clear the circular debt, but the threat of receivables pilling up remains significant for KAPCO. In addition to circular debt woes, the looming PPA renewal is also a key challenge for KAPCO.