The Du Pont technology and goodwill was purchased by Explosive Technology International (ETI) in 1988 and Biafo are the licensee of ETI in Pakistan. Biafo uses Du Pont's technology and formulations which include MMAN sensitisor, raw materials and control procedures. The company has a large market share and according to its website its clients include 20 major cement plants, 80 percent of international oil companies operating in Pakistan as well as construction and mining companies.

Biafo has signed contracts for the entire supply of explosives and accessories with Ghazi Barotha hydel project, China Geo Engineering for the Malakand Tunnel & Hydel Project, National Logistic Cell for explosives for all their projects as well as with China Petroleum Engineering Corporation for their Indus Highway Project. The company can produce 2500 metric tons of explosives per shift annually and it also produces a variety of detonators from technology obtained from Hanwha Group based in South Korea.

Stock performance and shareholding pattern Significant shareholders having more than 5 percent shareholding include Ayesha Humayun Khan who owns 25 percent of the company while Shayan Afzal Khan Abbas has 8 percent shareholding. Banks, DFIs, NBFCs, insurance companies and Modarabas cumulatively own 14.8 percent of Biafo Industries Limited while other individuals own almost 22 percent. Biafo's stock price has increased significantly over the past few years on the back of robust demand for its products as well as a sizeable market share. The company's stock continued to outperform the benchmark KSE-100 index by a wide margin throughout the past year in light of a number of significant orders closed by the company as well as strong financial results in FY18.

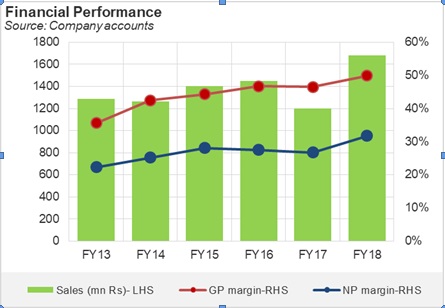

Historical performance Due to the specialised nature of its product Tovex Water Gel explosive, Biafo enjoys a solid grip over the explosives market in Pakistan. This dominance is apparent in the company's rocketing revenues and rising margins over the past five years.

In FY18, the company's overall revenues to all sectors with the exception of oil and gas sector increased. Sales to the O&G dipped by 21 percent on account of reduced seismic exploration programs. The company's local sales increased by 30 percent while export sales surged by 75 percent making the overall top line jump by 40 percent on a year-on-year basis. This major boost in revenue came about due to major road construction projects and large scale mining projects as well as hydel projects. The company's gross margins also picked up due to higher volume of sales while the finance costs saw a decline due to better cash management. FY18 was a good year for the company's bottom line as well, which increased by 66 percent.

Biafo also signed a joint venture agreement with Beijing Auxin Chemicals Technology Limited in FY17, following which Auxin Biafo Chemicals (Private) Limited (a private company limited by shares) was incorporated during FY18 for manufacturing and marketing of emulsion explosives. The paid up capital of the new company will be Rs50 million and Biafo Industries Limited will subscribe 49 percent of its share capital.

Recent snapshot The 1QFY19 saw the company's top line increase by 4 percent as compared to the same period last year. The period saw better supplies to O&G as there was an increased quantum of seismic exploration. The construction sector also witnessed increased demand but mining sector witnessed lower demand. Biafo's gross margins dipped ever so slightly on account of increase in raw material costs as well the currency devaluation which increased fuel and energy costs as well. The company's net profit saw negligible change.

Future outlook For Biafo, a lot depends on the future course of action pursued by the government especially the priority for infrastructure projects in hydel and road construction. The PSDP has already been slashed, which will certainly affect road construction projects but at the same time the hydel projects are still on the cards given the water crisis the country is facing. The company like the nation still awaits the finalisation of hydel projects including Mohmand and Diamer-Bhasha and any material progress on these will certainly prove to be a windfall for Biafo Industries Limited. The O&G sectors might see increased demand as well on account of increased seismic exploration activities and the company has sufficient capacity to accommodate even large increases in demand.

==========================================================================

Pattern of shareholding

==========================================================================

Categories of shareholders shares held %

==========================================================================

Directors. CEO & their Spouse and Minor Children

==========================================================================

M. Zafar Khan 1 4,497,610 20.44 4.497,610 20.44

Ms.Zishan Afzal Khan 792.220 3.6

Khawaja Amanullah Askari & Mrs. Ishrat Askari 330,000 1.5

Khwaja Ahmad Hosain 249.480 1.13

M. Afzal Khan 150,000 0.68

Adnan Aurangzeb 113,730 0.52

Ehsan Mani 87,450 0.4

M. Humayun Khan 66,000 0.3

Ms. Shirin Safdar 49,500 0.23

Ms. Shandana Humayun Khan 41.360 0.19

Maj. Gen. (Ret'd) S. Z. M. Askree 17,600 0.08

Ms. Mehreen Hosain 12.146 0.06

Muhammad Yaqoob & Maliha Yaqoob 1,100 0.01

Banks, DFIs, NBFCs. Insurance Companies. & Modarba 3.267.698 14.85

Mutual Funds:

CDC - Trustee AKD Opportunity Fund 222,709 1.01

CDC - Trustee Alfalah GHP Stock Fund 3,493 0.02

Other Individuals 4,782,904 21.74

Shareholders holding 5% or more shares in the Company:

Ms. Ayesha Humayun Khan 5.500.000 25

Ms. Shayan Afzal Khan Abbas 1,815,000 8.25

==========================================================================

SourceCompany accounts