Al-Abbas Sugar Mills Limited (PSX: AABS) has been in operation since 1991, and was listed on stock exchange the next year. Besides its primary business of manufacturing and marketing of white sugar, its principal activities include processing and sale of industrial ethanol, manufacturing of chemicals and alloys, tank terminal services providing bulk storage, and generation and sale of electricity to national grid.

Sugar crushing and processing unit of the company is located in district Mirpurkhas of Sindh province. The company currently operates at installed capacity of 7,500 tons of cane per day, which brings annual installed capacity to 1,125,000 based on industry standard of 150 days of crushing season. However, reported capacity varies based on actual number of days operated.

The sugarcane processing unit also has installed capacity to process byproduct molasses into industrial grade ethanol which has become an important revenue source for the company in recent years. Installed capacity for ethanol production currently stands at 170,000 litres per day. The Mirpurkhas mill unit also a 6MW captive power unit that caters to manufacturing unit's energy demands internally.

The company also has a captive coal power plant of 15MW located at Dhabeji which produces different chemicals and alloys with annual capacity of 27,220MT. The tank terminal unit is located at Kemari Karachi with storage capacity of 34,900 M.T of liquids

Sponsor group and pattern of shareholding

Al-Abbas Sugar Mills is a tightly held business with 57 percent of issued shareholding held by sponsors through associated undertakings, related parties, and direct shareholding by directors and their dependents belonging to the Haji Ghani and Shunaid Qureshi families. Additional minority shareholding of 21.4 percent belongs to the Jehangir Siddiqui group, which had a falling out with Qureshi and Haji Ghani families in 2013.

Majority control rests with the Haji Ghani-Shunaid Qureshi duo which also holds interests in other companies such as Power Cement, and Ghani Holdings as well.

Business analysis

The firm managed to stage a turnaround during the current year as it secured significant share of export orders against the export quota of two million tons announced by federal ministry of commerce at the beginning of crushing season in November 2017.

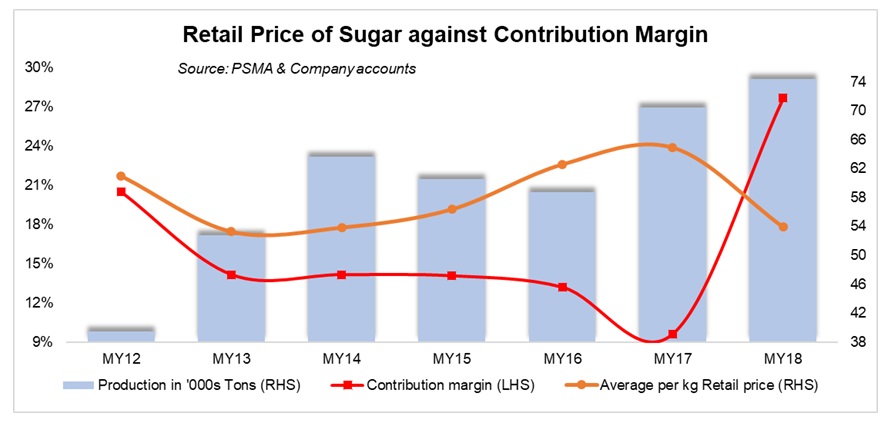

On gross basis, sugar division contributed 51 percent of total revenue, of which 88 percent came from export sales. SBP's disclosures indicate that the company received approval for export of 64,970 tons of sugar, which contributed total revenue of Rs3.4 billion, inclusive of freight subsidy estimated at minimum Rs700 million. Ex-subsidy and exchange gain, it appears that the company exported sugar at average Rs40,300 per ton, compared to average price of sugar of Rs50,000 per ton in domestic market.

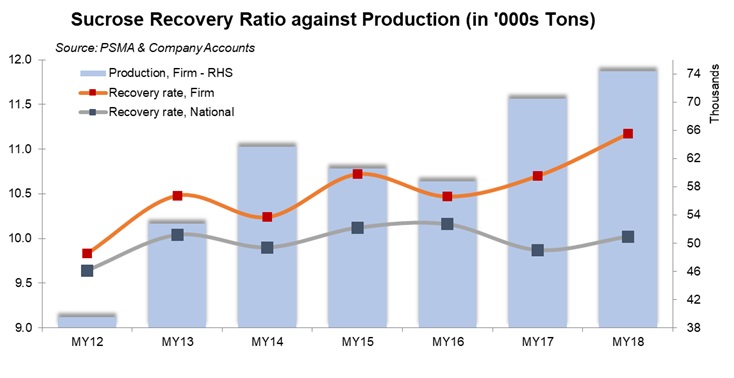

During the year, the company produced highest ever sugar volume thanks to third highest sucrose recovery level in the country. Sucrose level remained high at 11.17 percent due to favorable conditions in Sindh, as mills in the province performed better on average compared to mills in Punjab. At 11.17 percent, recovery level was 1.15 percentage points higher compared to national average.

The company began its year with an opening inventory of close to 40,000 tons of sugar, and produced additional sugar of 74,388 tons. During the year, the company managed to offload 74,903 tons of sugar in total, both domestic and export sales combined. Thus, close to 10,000 tons of sugar was sold in domestic market. The sugar division closed the year with ending inventory estimated at nearly 38,000 tons.

Ethanol division of the company also performed tremendously well. Al-Abbas Sugar is one of the few truly diversified sugars mills in the country which has historically derived up to 48 percent of total gross revenue from ethanol sales, which is primarily sold in export markets such as South Korea. The company produced 43,221 tons of ethanol, most of which it managed to sell off during the year due to high demand in foreign markets.

Sale volume of both divisions thus recorded growth over last year, leading to markedly improved financial performance compared to last year.

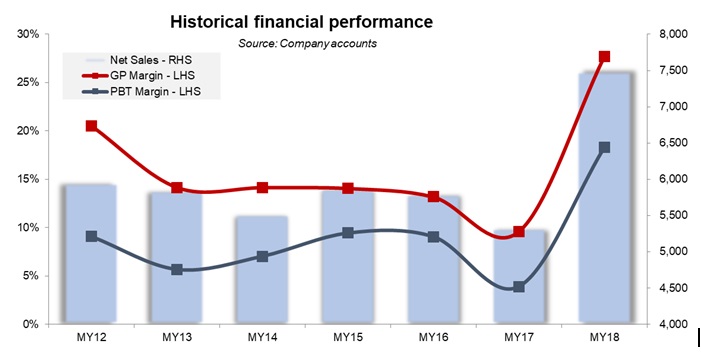

Financial analysis

Net sales grew by 41 percent, an additional of nearly Rs2 billion over the previous year. As subsidy and exchange gain is accounted for in top line, the company was able to keep increase in cost of sales in check, thus allowing gross profit margin to expand by nearly 18 percentage points.

Despite heavy subsidy of Rs700 million received by sugar division, segment gross margin stood at 15 percent. Segment profit for the year stood at Rs569 million, indicating that the sugar division would have recorded a loss had subsidy not been extended. During the previous marketing year, sugar division had recorded gross margin loss of 6 percent or Rs151 million as no subsidy was received and the company was not able to make any export sales.

In comparison, ethanol segment recorded gross margin of 41 percent or Rs1,504 million, with no support or subsidy from the government.

This was significant improvement on gross margin from last year, when segment gross margin stood at 25 percent. Other segments such as storage tank terminal contributed additional gross profits of Rs53 million.

Distribution cost increased significantly on account of heavy reliance on exports, with freight costs of Rs127.6 million recorded for export transportation. Thus, total distribution and marketing related expenses increases from a paltry Rs18 million to Rs144 million; however, should be netted off from government subsidy added to top line as it is extended to mills as refund for freight expense incurred.

Improved profitability led by subsidy on exports of sugar, and improved margin on ethanol business cascaded downwards, with operating margin growing 3.5 times over last year. Operating margin clocked in at a healthy 19 percent, from a little over 5.6 percent during last year.

Outlook

A simplistic analysis of the company's before tax profits of Rs1.4 billion would suggest that nearly half of Al-Abbas's bottom-line stems from subsidy received from the government. However, it must be noted that the firm's ethanol segment contributes high margins, and has in the past years helped minimized overall losses contributed by the sugar division. As a result, company reliance on revenue from ethanol business has increased in subsequent periods.

The country has opened marketing year 2019 with an opening stock of 2.4 million tons of sugar, before the crushing season began. As per news reports as well as industry sources, sugarcane crushing did not start well into December 2018.

As the new government has not announced any subsidy on export during the current season, export volume of sugar has also remained on the lower side during 1QMY19, with only JDW managing few export orders during January 2019. Total sugar exports by the country have remained under 20,000 tons.

Given average yield per hectare of 60 tons, and area under cultivation of 1.1 million hectares, total countrywide sugarcane production is estimated to clock in under 70 million tons, a steep decline from record levels of 84 million tons last year. Sugarcane production decline is explained by the delays in release of payments to farmers during the year before, who responded with switching to other crops such as rice.

As a result, overall sugar production by the sector is expected to clock in at no more than 5.5 million tons, estimated at average national sucrose recovery average of 10 percent and cane utilization level of no more than 80 percent of total crop output.

Given beginning stock of 2.4 million tons, sugar balance will clock in close to 7.9 million tons, exceeding domestic demand by 1.5 - 2.0 million tons. While the federal government has announced an export quota of 1.1 million tons, subsidy has not been announced, thus, exports sales are expected to remain on the lower side.

With no subsidy and excess supply, performance of the sector is expected to remain depressed. However, well-diversified businesses such as Al-Abbas Sugar are expected to pull through thanks to its high margin ethanol business.

======================================================

Al-Abbas Sugar Mills Limited

======================================================

Rs (mn) MY18 MY17 YoY

======================================================

Sales 7,494 5,327 41%

Cost of Sales (5,421) (4,756) 14%

Gross Profit 2,073 572 263%

Administrative expenses (106) (113) -6%

Distribution Costs (504) (195) 158%

Other operating income 53 49 9%

Other operating expenses (101) (11) 844%

Profit from operations 1,416 302 369%

Other income 19 18 7%

Finance cost (64) (112) -43%

Profit before tax 1,371 207 562%

Taxation (77) (64) 20%

Net profit for the period 1,294 143 805%

EPS (Rs) 8.23 26.37

GP margin 27.67% 10.73% +17.9pp

Operating margin 18.89% 5.66% +13.2pp

PBT margin 18.29% 3.88% +14.4pp

======================================================

Source: Company accounts